Health Insurance Open Enrollment: What You Need to Know for 2025

Introduction

Alright, friends, it’s that time of year again—Open Enrollment. Just hearing those words might make you want to hide under your covers, but don’t worry, I’m here to make sure you’re ready to face it head-on. Whether you’re a newbie or a seasoned vet, there’s always something new to learn when it comes to health insurance, and this year is no different. We’re going to break it down so you’re not out here making guesses with your health coverage. By the end of this blog, you’ll feel like a health insurance ninja, ready to take on Open Enrollment like a pro. And the best part? The Insurance Pros are here to guide you every step of the way.

What is Open Enrollment?

Let’s start with the basics: what exactly is Open Enrollment? Think of it as your annual opportunity to review, change, or enroll in a health insurance plan. Whether you’re looking to join a new plan, switch up your coverage, or stay where you are, this is your window of time to make those decisions. But here’s the catch—it’s a limited-time offer, my friends. The clock is ticking from November 1 to January 15, so you’ve got to make moves before the deadline passes. The good news? The Insurance Pros are ready to help you navigate this crucial period, ensuring you’re set up with the best possible coverage for the year ahead.

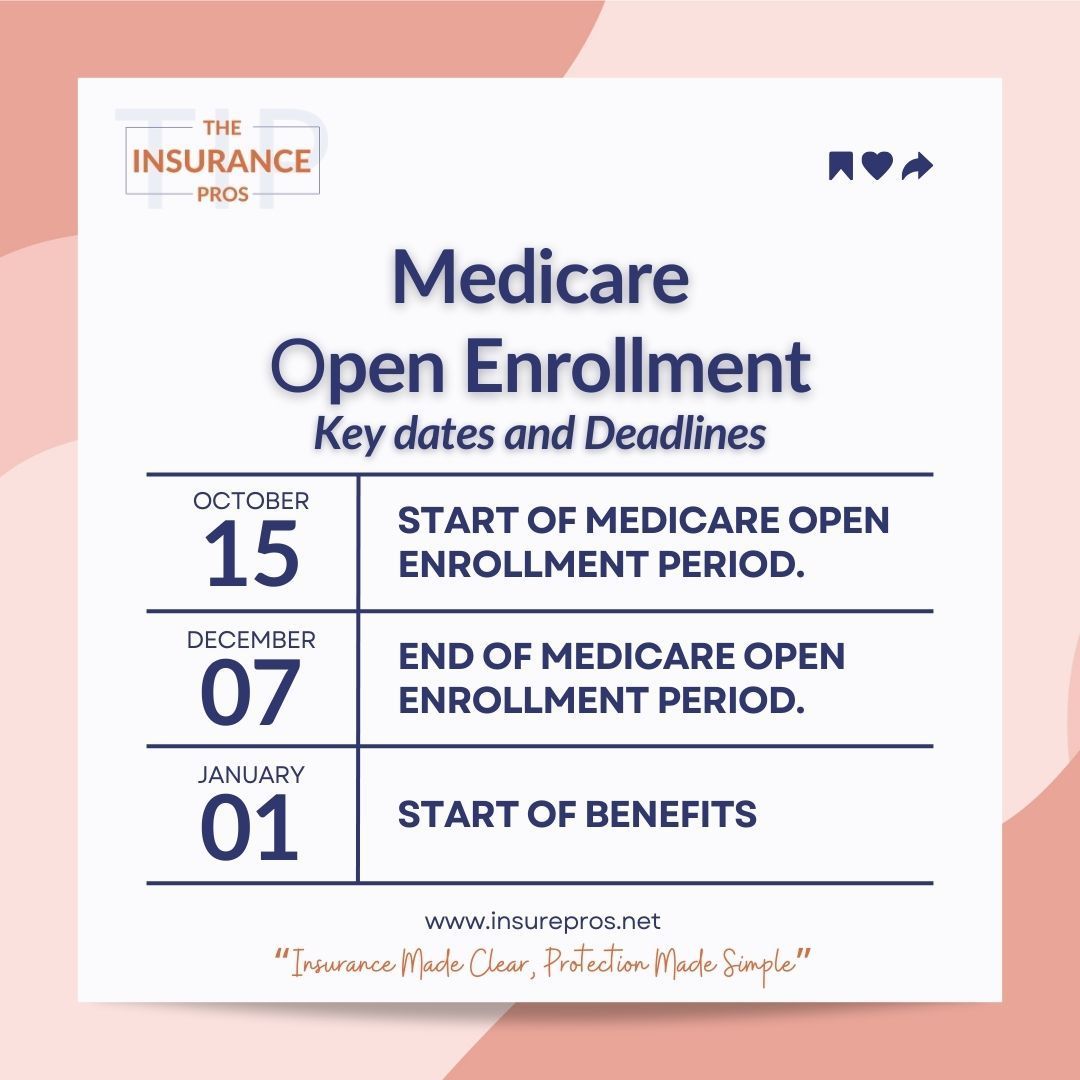

Key Dates to Remember: GRAPHIC WITH DATES

Mark those dates on your calendar, set a reminder on your phone—do whatever it takes to ensure you don’t miss this window. Trust me, you don’t want to be scrambling at the last minute.

Decoding Insurance Terms

Okay, now that we’ve got the basics out of the way, let’s talk about the language of health insurance. If you’re like most people, terms like “premium,” “deductible,” and “copayment” might as well be written in ancient hieroglyphics. But don’t worry, I’ve got you covered.

- Premium: This is what you pay each month just to have health insurance. Think of it like a subscription fee. Whether you use your insurance or not, this amount is coming out of your bank account.

- Deductible: This is the amount you have to pay out of your own pocket before your insurance starts kicking in. If your deductible is $1,000, you’ll need to pay that much in medical costs before your insurance starts to cover the bills.

- Copayment: This is a fixed amount you pay for a covered service, like a doctor’s visit or prescription. It’s your share of the cost, and it’s usually pretty small—think $20 or $30 per visit.

Understanding these terms is crucial because they directly affect your wallet. The Insurance Pros can break down these costs for you, helping you understand what you’ll be paying and when, so there are no surprises down the road.

Why Open Enrollment is Crucial

Now, let’s talk about why Open Enrollment is such a big deal. Life doesn’t stay the same, and neither should your health insurance. Maybe you got married, had a baby, or changed jobs—these are all major life events that can impact your coverage needs. Open Enrollment is your chance to review your current plan and make sure it still fits your life.

Not participating in Open Enrollment means you might be stuck with a plan that doesn’t work for you, or worse, you could face penalties if you’re uninsured. It’s not just about picking a plan; it’s about making sure you have the coverage you need to stay healthy and protected. The Insurance Pros are here to ensure you don’t miss out on this opportunity. They’ll help you assess your current situation, identify any gaps in coverage, and find a plan that meets your needs.

Conclusion

So, what have we learned today? Open Enrollment is your yearly chance to make sure your health insurance is working for you. It’s a limited window, so you’ve got to act fast. But don’t worry—you don’t have to do it alone. The Insurance Pros are ready to help you navigate the process, break down the confusing jargon, and find the perfect plan for you. Whether you’re looking to switch things up or stick with what you’ve got, they’ve got your back. Don’t let Open Enrollment pass you by—reach out to The Insurance Pros today and make sure you’re covered for 2025.

CONTACT INFORMATION

Phone:

(847) 954-7787

Fax: (773) 423-9204

Email:

info@insurepros.net

BUSINESS HOURS

Monday - Friday 8:00 am to 5:00 pm

Saturday 8:00 am to 12:00 pm

Sunday Closed