Blog

The Insurance Pros Blog:

Your Resource for Smart Coverage

By Carmen Londono

•

January 29, 2025

Listen, we get it—insurance isn’t exactly the first thing you want to deal with in the new year. But trust us, it’s about to be the easiest thing you check off your list in 2025. Here at The Insurance Pros, we’re more than policies and paperwork; we’re your go-to for peace of mind and confidence that your people, your home, your everything are covered. Here’s how we’re showing up this year to make insurance a breeze: 1. Clarity in Coverage You know how insurance feels like a foreign language? Like, “Am I supposed to have a dictionary for this?” We’re not doing that anymore. In 2025, we’re putting the fine print on blast and making sure you actually understand your coverage. No guessing. No confusion. Just straightforward info about what’s covered, what’s not, and what’s next. For real, when you sit down with us, you’ll leave knowing exactly how your policy protects you and your family. Because insurance isn’t supposed to make you feel like you’re solving a Rubik’s Cube. 2. Enhanced Client Education Let’s be honest: when it comes to insurance, the more you know, the less you panic. That’s why 2025 is the year we’re stepping up our education game. Think blogs that break it all down, videos that don’t bore you to tears, and myth-busting that makes you go, “Wait… I didn’t know that.” We’re also launching a newsletter! Want exclusive tips, updates, and answers to your burning insurance questions delivered straight to your inbox? Head over to our Contact Us page to sign up for our emails. Staying informed has never been easier. And that’s not all—we’re bringing even more helpful info to our social media. Follow us for practical advice, timely updates, and a little humor to brighten your day. Insurance doesn’t have to be dull, and we’re here to prove it. 3. Community Connection We’re not just the folks you call for insurance; we’re part of your neighborhood. This year, we’re getting out there and showing up for our communities. Local events? We’ll be there. Supporting initiatives that make life better for you and yours? Count us in. 2025 is about building connections that matter—and not just in business. Whether it’s sharing resources or helping families get the protection they need, we’re here for you. 4. Stress-Free Service Life’s already stressful enough. The last thing you need is your insurance giving you a headache. That’s why we’re making everything smoother—from policy reviews to claims to renewals. Simple. Quick. Done. We’ve got new tools coming your way, like a client portal and automated reminders, so you can stay on top of your coverage without lifting a finger. When we say “stress-free insurance,” we mean it. We Want to Hear from You What are your 2025 goals? Protecting your family? Growing your business? Finally getting your insurance in order? Whatever it is, we’re here to help make it happen. We’re inviting you to share your goals with us. How can we support you this year? Whether it’s personalized advice or just being there when you need us, we’re ready to partner with you every step of the way. Here’s to a Great Year Ahead 2025 is a new chapter, and we’re so grateful to be part of your story. Thank you for trusting us with what matters most. At The Insurance Pros, we’re ready to help you navigate whatever comes next—with confidence, clarity, and zero drama. Here’s to a year of protection, peace of mind, and progress—together.

By Carmen Londono

•

December 31, 2024

As the holiday season approaches, we at The Insurance Pros (TIP) want to extend our warmest wishes to our cherished clients and partners. Reflecting on the past year, we're filled with gratitude for the trust you've placed in us and the milestones we've achieved together. This year, we expanded our comprehensive insurance solutions, ensuring that your life, assets, and peace of mind remain our top priorities. From personalized home and auto coverage to tailored business insurance plans, we've been dedicated to providing protection that truly works when life gets real. A highlight of 2024 was our commitment to assisting small and micro businesses in entering the group market. We introduced options like One Person Group plans, allowing business owners to secure quality coverage for themselves or retain that rockstar employee in need of better benefits. As we look forward to 2025, we're excited to continue offering insurance made clear and protection made simple. Your support has been instrumental in our success, and we're eager to keep delivering the reliable and affordable coverage you deserve. ✨ From all of us at TIP, may your holidays be filled with joy, and may the new year bring you health, happiness, and prosperity. Here's to another year of protecting what matters most! Call to Action: As we gear up for another amazing year, let us be your go-to for all things insurance. Whether it's protecting your home, business, or future, we're here to make coverage clear and hassle-free. Visit insurepros.net to explore how we can help you start 2025 with confidence! 💼📞

By Carmen Londono

•

October 4, 2024

Dr. José Celso Barbosa, a man who was out here in the 1800s breaking molds and making history. When we say “trailblazer,” we mean it! Born on July 27, 1857, Barbosa wasn’t just the first Black Puerto Rican to practice medicine in Puerto Rico—he was one of the first Black men to earn a medical degree in the U.S., period. He didn’t just break down doors; he paved a whole highway for generations after him, from medical innovation to political activism and even inventing a little thing we now call “employer-based health insurance.” Yes, he did that too. Schooling and Straight-Up Determination: A Role Model for the Ages Barbosa’s journey to becoming a doctor? Not for the faint-hearted. This was the late 19th century, where being Black, Puerto Rican, and ambitious enough to attend the University of Michigan for medical school was unheard of. But Barbosa wasn’t about to let anything stop him. He graduated in 1880, kicking down barriers and showing other Hispanic and Black folks that medicine, too, could be their calling. This man’s hustle didn’t just make him a doctor—it made him a beacon for everyone dreaming bigger than the world thought they could. Employer-Based Health Insurance? Yeah, He Was That Visionary Barbosa didn’t just want to be any doctor; he wanted to make healthcare work for the people. When he got back to Puerto Rico, he looked around and saw the healthcare crisis brewing for low-income families. So, what did he do? He set up a mutual aid system, asking people to contribute a small monthly fee to cover their healthcare costs when needed. Yup, he practically invented employer-based health insurance right there in Puerto Rico. It was revolutionary. Quality healthcare, he believed, shouldn’t be a luxury; it’s a right. This man was doing 21st-century things in the 1800s! Politics and the Fight for Puerto Rican Autonomy Now, as if medicine and employer-based health insurance weren’t enough, Barbosa decided to jump into politics. In 1899, he started the Puerto Rican Republican Party, giving Puerto Ricans a voice and demanding equal representation. He was all about empowering his people, and his political legacy is still a blueprint for leaders fighting for Puerto Rican rights today. Barbosa was about Puerto Rican dignity, identity, and autonomy, and he wasn’t afraid to challenge power structures to make that happen. Honoring Dr. Barbosa During Hispanic Heritage Month Dr. José Celso Barbosa didn’t just live a life; he made history. He’s what Hispanic Heritage Month is all about—honoring those who paved the way, lifted communities, and demanded better for everyone around them. Barbosa’s legacy is proof of the power of pushing boundaries and standing up for what’s right, even when the world isn’t ready. This month, we celebrate his work, his courage, and his relentless pursuit of justice. Let his story remind us to keep fighting, keep dreaming, and always keep looking out for each other.

By Carmen Londono

•

September 12, 2024

It’s Q4! Time to get smart about your health coverage. New plans, better networks, and some serious savings are up for grabs. Don’t let this opportunity pass you by—let’s break down how The Insurance Pros can help you lock in the best plan for your wallet and your health!

By Carmen Londono

•

August 30, 2024

Hey there! Gather 'round, because we’re about to dive into immunization coverage in Illinois health insurance plans. Whether you're a vaccine enthusiast or a bit hesitant, this info is going to make you smarter and ready to navigate that insurance maze like a pro. Why Immunizations Matter First, let’s talk about why immunizations are a big deal. Immunizations play a crucial role in keeping you alive and kicking. They protect you from a whole range of nasty diseases that can seriously mess with your health. From the time you’re a baby to when you’re all grown up, these shots keep you safe and healthy. Plus, staying up-to-date with your vaccines means you’ll recover faster if you do get sick, and it helps protect the people around you too. It's about building a strong defense for you and your community. What’s Covered? Alright, now let’s dive into what your health insurance in Illinois covers when it comes to immunizations. Most health plans have to cover a bunch of vaccines without making you pay out-of-pocket. That’s thanks to the Affordable Care Act (ACA). Here’s a quick rundown of some shots that are usually covered: Kids: Chickenpox , measles, mumps, rubella (MMR) , polio , whooping cough (pertussis) , and more. Teens: HPV , meningococcal , and Tdap (tetanus, diphtheria, pertussis) . Adults: Flu shot , shingles (for those over 50), and pneumonia (for older folks or those with certain health conditions). Pretty cool, right? Your plan might cover even more, so it’s always a good idea to check with your provider. How to Make Sure You’re Covered You don’t want surprises when it's time for your shot. Here’s how to make sure you’re covered: Check Your Plan: Go through your health insurance policy or give them a call to see exactly what’s covered. In-Network Providers: Make sure you’re going to a doctor or clinic that’s in your insurance network. Going out-of-network could mean you’ll end up paying more. Stay Informed: Keep track of your immunization schedule. If you’re unsure about what vaccines you need, don’t be shy—ask your doctor! The CDC’s immunization schedule is a great resource. What If You’re Uninsured? No insurance? No problem. Illinois has got your back. Programs and local health departments can help you get vaccinated at little or no cost. It’s all about keeping everyone in our community healthy. A few are listed here- Vaccines for Children (VFC) Program Provides free vaccines to eligible children. Learn more: CDC’s VFC Program . Illinois Department of Public Health (IDPH) Offers immunization services statewide. Learn more: IDPH Immunization Page . Federally Qualified Health Centers (FQHCs) Provides immunizations on a sliding fee scale. Find a center near you: IPHCA . Local Health Departments Many local health departments provide low-cost vaccines. Locate yours: IDPH Directory . Chicago Department of Public Health (CDPH) Provides free and low-cost vaccines through city clinics. Learn more: CDPH Immunization Program . Ready to take charge of your health? Immunizations are key to keeping you and your community safe and healthy. Don’t wait—check your health insurance plan today to see what’s covered, make sure you’re visiting in-network providers, and stay informed with the CDC’s immunization schedule. Let's roll up those sleeves and stay protected! Call us now and keep your immunizations up-to-date. Your health matters, and staying on top of your vaccines is a powerful step towards a healthier future for you and those around you. Stay healthy, stay informed, and keep that immune system ready for anything!

By Carmen Londono

•

August 30, 2024

Introduction Alright, friends, it’s that time of year again—Open Enrollment. Just hearing those words might make you want to hide under your covers, but don’t worry, I’m here to make sure you’re ready to face it head-on. Whether you’re a newbie or a seasoned vet, there’s always something new to learn when it comes to health insurance, and this year is no different. We’re going to break it down so you’re not out here making guesses with your health coverage. By the end of this blog, you’ll feel like a health insurance ninja, ready to take on Open Enrollment like a pro. And the best part? The Insurance Pros are here to guide you every step of the way. What is Open Enrollment? Let’s start with the basics: what exactly is Open Enrollment? Think of it as your annual opportunity to review, change, or enroll in a health insurance plan. Whether you’re looking to join a new plan, switch up your coverage, or stay where you are, this is your window of time to make those decisions. But here’s the catch—it’s a limited-time offer, my friends. The clock is ticking from November 1 to January 15, so you’ve got to make moves before the deadline passes. The good news? The Insurance Pros are ready to help you navigate this crucial period, ensuring you’re set up with the best possible coverage for the year ahead. Key Dates to Remember: GRAPHIC WITH DATES Mark those dates on your calendar, set a reminder on your phone—do whatever it takes to ensure you don’t miss this window. Trust me, you don’t want to be scrambling at the last minute. Decoding Insurance Terms Okay, now that we’ve got the basics out of the way, let’s talk about the language of health insurance. If you’re like most people, terms like “premium,” “deductible,” and “copayment” might as well be written in ancient hieroglyphics. But don’t worry, I’ve got you covered. Premium: This is what you pay each month just to have health insurance. Think of it like a subscription fee. Whether you use your insurance or not, this amount is coming out of your bank account. Deductible: This is the amount you have to pay out of your own pocket before your insurance starts kicking in. If your deductible is $1,000, you’ll need to pay that much in medical costs before your insurance starts to cover the bills. Copayment: This is a fixed amount you pay for a covered service, like a doctor’s visit or prescription. It’s your share of the cost, and it’s usually pretty small—think $20 or $30 per visit. Understanding these terms is crucial because they directly affect your wallet. The Insurance Pros can break down these costs for you, helping you understand what you’ll be paying and when, so there are no surprises down the road. Why Open Enrollment is Crucial Now, let’s talk about why Open Enrollment is such a big deal. Life doesn’t stay the same, and neither should your health insurance. Maybe you got married, had a baby, or changed jobs—these are all major life events that can impact your coverage needs. Open Enrollment is your chance to review your current plan and make sure it still fits your life. Not participating in Open Enrollment means you might be stuck with a plan that doesn’t work for you, or worse, you could face penalties if you’re uninsured. It’s not just about picking a plan; it’s about making sure you have the coverage you need to stay healthy and protected. The Insurance Pros are here to ensure you don’t miss out on this opportunity. They’ll help you assess your current situation, identify any gaps in coverage, and find a plan that meets your needs. Conclusion So, what have we learned today? Open Enrollment is your yearly chance to make sure your health insurance is working for you. It’s a limited window, so you’ve got to act fast. But don’t worry—you don’t have to do it alone. The Insurance Pros are ready to help you navigate the process, break down the confusing jargon, and find the perfect plan for you. Whether you’re looking to switch things up or stick with what you’ve got, they’ve got your back. Don’t let Open Enrollment pass you by—reach out to The Insurance Pros today and make sure you’re covered for 2025.

By Carmen Londono

•

August 30, 2024

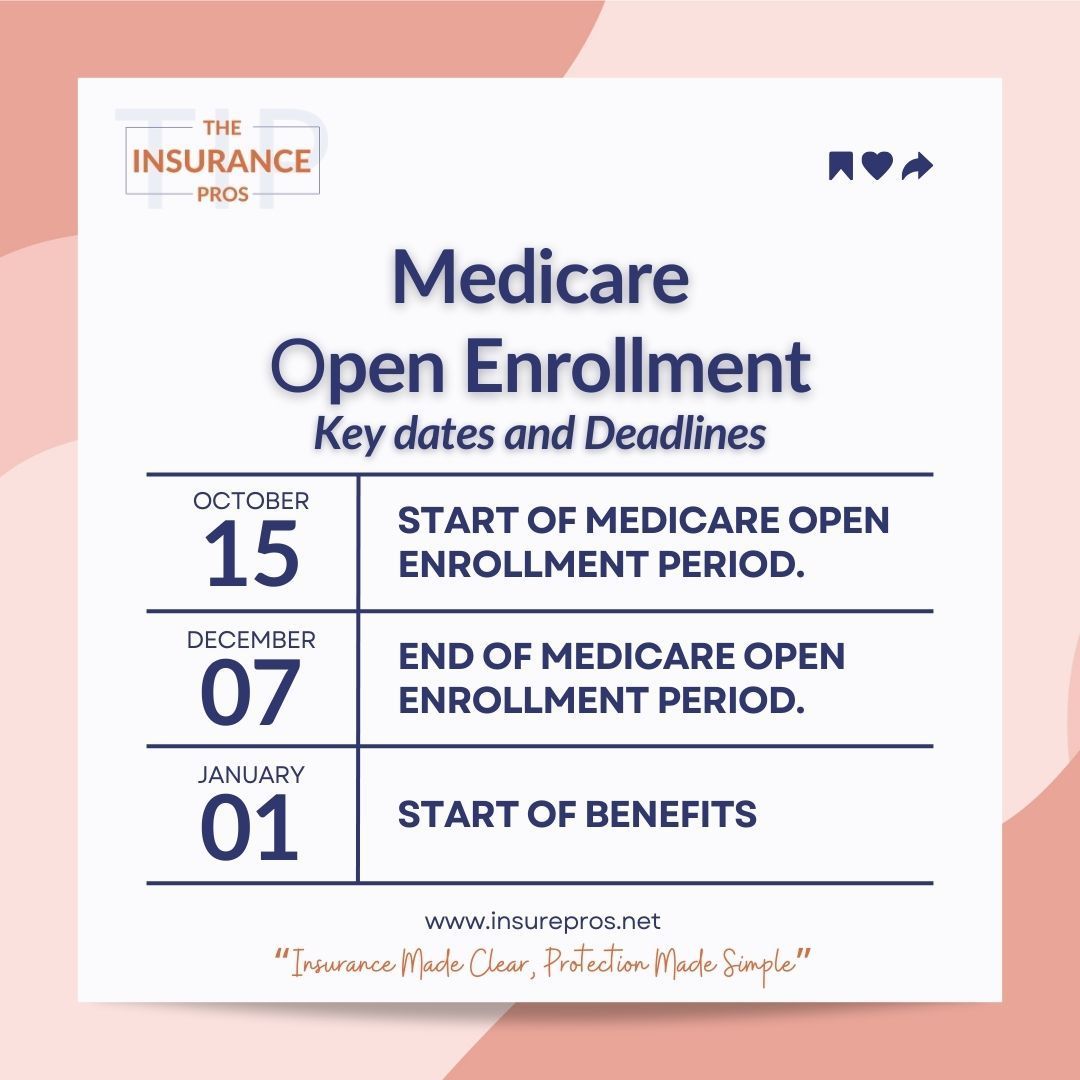

Introduction: The 2024 Medicare Open Enrollment season is right around the corner—October 15 to December 7, to be exact. This is your golden opportunity to review your Medicare coverage and make any changes necessary to ensure you’re getting the most out of your plan. Whether you need to switch from Original Medicare to a Medicare Advantage plan, join a new drug plan, or just update your coverage, this is the time to do it. But don’t worry, The Insurance Pros are here to help you navigate these changes and make the best decision for your healthcare needs. Key Updates in 2025: Prescription Drug Coverage: This year, there are significant changes in Medicare Part D prescription drug coverage. With new caps on insulin costs and out-of-pocket expenses, you could save a lot—if you’re on the right plan. The Insurance Pros can review your current plan and compare it with new options, ensuring you’re not missing out on these potential savings. Telehealth Services: Telehealth is here to stay, and Medicare is expanding its coverage for these services. But not all plans are created equal when it comes to telehealth. The Insurance Pros can guide you through the maze of options to find a plan that gives you the flexibility to consult with your healthcare provider from the comfort of your home. New Plan Options: 2024 brings several new Medicare Advantage plans with unique benefits like fitness programs, transportation services, and more. With so many options, it can be overwhelming to figure out which one is right for you. The Insurance Pros will help you sift through the details, comparing benefits, costs, and network coverage to find the perfect fit for your needs. Enrollment Period Insights: Remember, you can make these changes between October 15 and December 7. You can join, drop, or switch to a Medicare Advantage plan, switch from Original Medicare to Medicare Advantage, or switch from one Medicare drug plan to another. You can also update your coverage by switching to a new plan from your current insurer or by choosing a new insurer altogether. And if you’re under 65 and receive Social Security or Railroad Retirement Board benefits, you might be automatically enrolled in Original Medicare. Plus, if you need to make any changes during the Medicare Advantage Open Enrollment period, you have from January 1 to March 31 to do so, with your new plan benefits taking effect for the rest of the year. How The Insurance Pros Can Help: Navigating these changes can be overwhelming, but The Insurance Pros are here to help. They stay up-to-date with the latest changes and trends, so you don’t have to. Whether you need help understanding new benefits, comparing plans, or just want someone to explain what all these changes mean for you personally, The Insurance Pros are your go-to resource. They’ll make sure you’re fully informed and confidently enrolled in the best plan for 2024.

By Carmen Londono

•

June 27, 2024

Hey, guys! Let's have a little chat about something super important—your health. Yep, I know it’s not the most exciting topic, but trust me, it’s worth a few minutes of your time. Whether you’re hitting the gym, playing a weekend game of basketball, or just trying to keep up with the kids, taking care of your health is key. And having the right insurance can make a world of difference. So, let’s dive into some essential coverage tips for men in Illinois. Ready? Let’s go! Why Men’s Health Matters Before we get into the nitty-gritty of insurance, let’s talk about why your health matters. Men often skip regular check-ups and ignore symptoms, but early detection and prevention are crucial. Regular health screenings can catch issues before they become serious, and having the right insurance ensures you get the care you need without breaking the bank. Common Health Concerns for Men Heart Disease: The leading cause of death for men in the U.S. Regular screenings and lifestyle changes can help manage and prevent heart disease. Cancer: Prostate, lung, and colorectal cancers are among the most common. Early detection through screenings can significantly improve treatment outcomes. Diabetes: A growing concern for many men, especially those with a family history. Regular screenings can help manage and prevent diabetes. Mental Health: Depression and anxiety are common but often overlooked. Mental health is just as important as physical health and should be treated with equal importance. Respiratory Diseases: Conditions like chronic obstructive pulmonary disease (COPD) are common, especially in smokers. Early detection and treatment are vital. Reproductive Health: Issues like low testosterone, erectile dysfunction, and prostate problems are common. Regular check-ups and open conversations with your doctor can help manage these concerns. Must-Have Insurance Coverage Routine Check-Ups and Preventive Care: Regular visits to your primary care physician are essential. Preventive care includes screenings for blood pressure, cholesterol, diabetes, and certain cancers. Make sure your insurance covers these routine visits and tests. Many preventive services are federally mandated to be free or covered 100%, so no excuses! Specialist Visits: Sometimes you need to see a specialist—whether it’s for your heart, joints, or another issue. Ensure your insurance plan includes specialist visits without needing excessive referrals or jumping through hoops. Mental Health Coverage: Mental health is just as important as physical health. Look for a plan that offers mental health services, including therapy and counseling, without high out-of-pocket costs. Prescription Coverage: If you need medication, having good prescription coverage is a must. Check if your plan covers both generic and brand-name drugs and what the co-pays look like. Emergency and Hospital Care: Accidents happen. Make sure your plan covers emergency room visits and hospital stays. It’s better to be safe than sorry! Key Screenings and Tests for Men Taking care of your health means getting the right screenings at the right times. Here’s a rundown of essential screenings for men, and remember, many of these are federally mandated to be free or covered 100%: Blood Pressure Screening When: Starting at age 18, at least once every two years. Coverage: Federally mandated to be free. Cholesterol Check When: Starting at age 20, every 4-6 years. Coverage: Federally mandated to be free. Diabetes Screening When: Starting at age 45, every 3 years. Coverage: Federally mandated to be free. Colorectal Cancer Screening (Colonoscopy) When: Starting at age 50, every 10 years, or earlier and more frequently if you have a family history of colorectal cancer. Coverage: Federally mandated to be free. Prostate Cancer Screening When: Starting at age 50, or 40-45 if you have a family history. Coverage: Check with your insurer, as coverage can vary. Skin Cancer Screening When: Annually, especially if you have a history of sunburns or family history. Coverage: Often covered, but check with your insurer. Mental Health Screening When: Annually, or as needed. Coverage: Federally mandated to be free. Reproductive Health Screening When: Regularly, especially if experiencing symptoms like low libido or erectile dysfunction. Coverage: Often covered, but check with your insurer. Tips for Choosing the Right Plan Know Your Health Needs: Are you someone who rarely gets sick, or do you have a chronic condition that requires regular care? Choose a plan that fits your lifestyle and health needs. Check the Network: Make sure your preferred doctors and hospitals are in-network. Out-of-network care can be significantly more expensive. Consider the Costs: Look at the premiums, deductibles, co-pays, and out-of-pocket maximums. Sometimes a higher premium plan with lower out-of-pocket costs is better if you need frequent care. Look for Added Benefits: Some plans offer perks like gym memberships, wellness programs, or telehealth services. These can be great additions to your health routine. Read the Fine Print: Understand what is and isn’t covered. Some plans may have limitations or require prior authorizations for certain services. Insurance Options in Illinois Living in Illinois, you have several insurance options, whether you’re employed, self-employed, or looking for coverage on your own. Here are a few: Employer-Sponsored Plans: If you’re employed, check out the health plans offered by your employer. These often come with lower premiums due to group rates. Marketplace Plans: The Health Insurance Marketplace offers various plans, and you might qualify for subsidies based on your income. Medicaid: If you meet certain income requirements, you might be eligible for Medicaid. This provides comprehensive coverage at little to no cost. Private Insurance: For those who want more control over their plans, private insurance is an option. Compare different plans and providers to find the best fit. Take Action Today Your health is your most valuable asset. Don’t wait until something goes wrong to think about insurance. Review your current coverage, see where you might need more protection, and make sure you’re getting the best possible care. If you’re unsure about where to start, reach out to an insurance agent—they’re there to help you navigate the options and find the best plan for your needs. Call to Action Ready to level up your health game? Contact us at Insurance Pros for a personalized consultation. We’ll help you find the best insurance coverage to keep you healthy and thriving. Visit our website or give us a call today! Here’s to taking charge of your health and living your best life! 💪

By Carmen Londono

•

June 19, 2024

Hey, business owners! Summer is here, and if you’re in Chicago or anywhere in the Midwest, you know this season is all about bustling streets, festivals, and tourists galore. Whether you’re running a lakeside café, a landscaping service, or a boutique hotel, the summer rush can bring both excitement and challenges. One thing you definitely don’t want to overlook is your business insurance. Let’s dive into why seasonal business insurance is a must and how to get your business ready for the sunny months ahead. What is Seasonal Business Insurance? First things first, what exactly is seasonal business insurance? It’s a type of insurance designed specifically for businesses that experience significant fluctuations in activity throughout the year. Think of it as tailored coverage that ramps up when you’re busiest and scales back when things are slower. It’s all about having the right protection at the right time. Why You Need It Let’s be real, the summer rush can be a rollercoaster. Here’s why seasonal business insurance is crucial: Increased Liability: With more customers, there’s a higher chance of accidents and injuries. Whether it’s a slip-and-fall at your ice cream stand in Navy Pier or a mishap on your boat rental at Lake Michigan, you need coverage that can handle the increased liability. Property Protection: Summer often means more inventory, equipment, and cash on hand. Seasonal insurance ensures your property is protected against theft, damage, or loss during peak times. Employee Coverage: If you’re hiring seasonal staff, make sure they’re covered. Workers’ compensation and liability insurance are essential to protect both your employees and your business. Business Interruption: Summer storms, power outages, or unexpected events can disrupt your operations. Business interruption insurance can help cover lost income and ongoing expenses if you have to close temporarily. Benefits of Seasonal Business Insurance Cost-Effective: Seasonal insurance can be more affordable than year-round coverage. You pay for the protection you need when you need it, without over-insuring during slower periods. Flexible Coverage: Customize your policy to match the unique risks and needs of your business during peak season. It’s like having a safety net that adapts to your business cycles. Peace of Mind: Knowing you’re covered allows you to focus on running your business and serving your customers without worrying about unexpected setbacks. Preparing Your Business for the Summer Rush Now that we’ve covered why seasonal business insurance is essential, let’s talk about getting ready for the summer surge: Review Your Current Policy: Take a close look at your existing insurance policy. Are there gaps in coverage that could leave you vulnerable during peak season? It might be time for an update. Assess Your Risks: Consider the specific risks your business faces in the summer. Are you prepared for increased foot traffic, more transactions, or outdoor events? Make sure your insurance covers these scenarios. Inventory Check: Conduct a thorough inventory check. Ensure you have adequate coverage for all your stock and equipment, especially if you’re ramping up for the season. Hire Smart: If you’re bringing on seasonal workers, make sure they’re properly trained and aware of safety protocols. Confirm they’re covered under your workers’ compensation policy. Plan for the Unexpected: Have a contingency plan in place for potential disruptions. Whether it’s a natural disaster or a supply chain issue, being prepared can make all the difference. Real-Life Example Let’s look at a real-life example. Jenny owns a popular café in Chicago’s bustling downtown area. Last summer, a sudden storm caused significant damage to her outdoor seating area. Fortunately, Jenny had seasonal business insurance that covered the repair costs and business interruption. She was able to reopen quickly and continue serving her customers without a hitch. Conclusion The summer rush in Chicago and the Midwest is an exciting time for many businesses, but it also comes with its own set of challenges. Seasonal business insurance is your best ally in navigating these busy months with confidence. By ensuring you have the right coverage, you can protect your business, employees, and customers, and enjoy a successful summer season. Call to Action Ready to get your business summer-ready? Contact us at Insurance Pros for a free consultation and find the perfect seasonal business insurance plan for your needs. Visit our website or give us a call—we’re here to help you thrive this summer! So, gear up and get covered. Let’s make this summer your best one yet, with all the fun and none of the worries. Here’s to a sunny, successful season! 🌞🏖️

By Carmen Londono

•

June 17, 2024

Hey there, Gen Xers and Millennials! I know, I know—long-term care insurance might not be at the top of your priority list. Between juggling careers, family, and maybe even some TikTok time, thinking about long-term care can feel like something for way down the road. But here’s the thing: planning now can save you a lot of stress (and money) later. So, grab your favorite drink, get comfy, and let’s chat about why you should start caring about long-term care insurance today. What is Long-Term Care Insurance? First things first, what exactly is long-term care insurance? It’s a type of insurance designed to cover the costs of long-term care services, which aren’t typically covered by regular health insurance or Medicare. This can include help with daily activities like bathing, dressing, and eating, whether at home, in a community setting, or in a nursing home. Think of it as a safety net for your future self. Why Should Gen X and Millennials Care? Let’s be real for a second—thinking about needing long-term care isn’t exactly a fun topic. But here’s why it matters: Costs Can Be Astronomical: Long-term care is expensive. In fact, the average cost of a private room in a nursing home is over $100,000 per year. Without insurance, these costs can quickly drain your savings and impact your family’s financial security. Family Impact: Many of us expect family members to step in and help out, but providing long-term care can be physically, emotionally, and financially draining for loved ones. Having insurance can alleviate some of this burden. Early Planning = Lower Costs: The younger you are when you purchase long-term care insurance, the lower your premiums will be. Waiting until you’re older can significantly increase costs, and you might also face health issues that make it harder to get coverage. Increasing Life Expectancy: We’re living longer than ever, which means more years where we might need a little extra help. Planning now ensures you’re prepared for the long haul. Benefits of Long-Term Care Insurance So, what’s in it for you? Here are some key benefits of having long-term care insurance: Financial Protection: Protect your savings and assets from the high costs of long-term care services. Choice of Care: Insurance gives you more options when it comes to choosing the type of care you receive and where you receive it. Peace of Mind: Knowing you’re covered allows you to focus on enjoying life without worrying about the “what ifs.” Support for Family: Reduce the emotional and financial strain on your family by ensuring they won’t have to bear the full burden of your care. How to Get Started Ready to start planning? Here are some steps to get you on your way: Assess Your Needs: Think about your family health history and lifestyle. Do you have a history of chronic illnesses? Do you lead a healthy, active lifestyle? Research Policies: Not all long-term care insurance policies are the same. Look at different options, compare benefits, and check out customer reviews. Talk to an Expert: Reach out to an insurance professional who can help guide you through the process and find a policy that fits your needs and budget. Plan Early: Remember, the earlier you start, the better. Don’t wait until you’re older and premiums are higher. Questions to Ask an Agent When you’re ready to talk to an insurance agent, here are some questions to help you get the best coverage: What Does the Policy Cover? Make sure you understand exactly what services and types of care are included in the policy. What Are the Exclusions? Know what is not covered to avoid any surprises down the road. What Are the Premiums and How Do They Increase Over Time? Get a clear picture of your financial commitment now and in the future. Is There an Inflation Protection Option? This can help your benefits keep pace with rising costs over time. What Are the Eligibility Requirements for Benefits? Understand what conditions must be met to start receiving benefits. Are There Any Discounts Available? Ask about any discounts for healthy living, joint policies, or other factors. What Are the Payment Options? Find out if you can pay monthly, quarterly, or annually, and if there are any benefits to each option. How Long Are the Benefits Paid? Check the duration of the coverage to ensure it meets your potential needs. Can the Policy Be Customized? See if you can tailor the policy to better fit your personal situation and future needs. Conclusion Long-term care insurance might not be the most exciting thing to think about, but it’s one of the smartest moves you can make for your future self. By planning now, you’re not just protecting your finances—you’re also giving yourself and your family the gift of peace of mind. So, why wait? Start exploring your options today and set yourself up for a worry-free future. Call to Action Ready to learn more about long-term care insurance? Contact us at Insurance Pros for a free consultation and let’s find the perfect plan for your needs. Visit our website or give us a call—we’re here to help you every step of the way. Here’s to planning smart and living well! 🌟

By Carmen Londono

•

June 17, 2024

Hey there, summer’s almost here! 🌞 That means it’s time for sunshine, beach days, and exciting travel plans. Whether you’re jetting off to a tropical paradise or taking a road trip across Illinois, you’ve probably been daydreaming about your perfect getaway. But before you pack your bags and grab your sunscreen, let’s chat about something that might not be on your radar—travel insurance. Yep, I know it’s not the most glamorous topic, but stick with me. It could save your vacation! What is Travel Insurance? Alright, so what exactly is travel insurance? Think of it as your safety net when you’re away from home. It’s designed to protect you from those “just in case” moments. You know, those unexpected things that can pop up and throw a wrench in your travel plans. Travel insurance can cover everything from trip cancellations and medical emergencies to lost luggage and travel delays. It’s like having a little guardian angel watching over your vacation. Why Consider Travel Insurance? Let’s get real for a second. Life happens, even when you’re on vacation. Here’s why travel insurance might be your new best friend: Unexpected Cancellations: Imagine you’ve planned the perfect trip, but then you get sick, or there’s a family emergency. Travel insurance can help you get your money back for those non-refundable expenses. Medical Emergencies: If you’re traveling abroad, your regular health insurance might not cover you. Travel insurance steps in to cover those unexpected medical bills. Because the last thing you want is to be stuck with a huge bill while trying to enjoy your trip. Lost or Delayed Luggage: We’ve all heard horror stories about lost luggage. Travel insurance can reimburse you for the essentials if your bags go missing or are delayed. No more stressing about your favorite outfits being stuck in transit. Travel Delays: Weather happens, flights get delayed, and connections get missed. Travel insurance can cover extra expenses like hotels and meals if you’re stuck somewhere unexpectedly. Benefits of Travel Insurance Now, let’s talk about the perks of having travel insurance: Peace of Mind: Knowing you’re covered for those “what if” moments lets you relax and enjoy your trip without worry. Financial Protection: Vacations can be a big investment. Travel insurance helps protect that investment, so you don’t lose out if something goes wrong. Assistance Services: Many travel insurance plans offer 24/7 assistance services. Need help finding a doctor or rebooking a flight? They’ve got your back. Considerations Before Purchasing Before you rush off to buy travel insurance, here are a few things to keep in mind: Evaluate Your Needs: Think about your travel plans and what kind of coverage makes sense for you. Are you going somewhere with high medical costs? Planning a pricey trip? Check Existing Coverage: Sometimes your credit card or health insurance might offer some travel coverage. Check what you already have so you don’t buy something you don’t need. Read the Fine Print: Not all travel insurance policies are created equal. Make sure you understand what’s covered and what’s not. You don’t want any surprises! Real-Life Examples Let’s hear from some real people who’ve been there: Casey’s Story: Casey was all set for a dream vacation in Europe when her flight got canceled due to a storm. Thanks to her travel insurance, she got reimbursed for her extra hotel nights and meals while she waited for the next flight. Alex’s Adventure: Alex fell while hiking in the mountains and needed emergency medical care. Her travel insurance covered the hospital bills, which would have been a huge hit to her savings otherwise. These stories are just a few examples of how travel insurance can turn a potential disaster into a minor hiccup. How to Choose the Right Travel Insurance Choosing the right travel insurance can feel overwhelming, but it doesn’t have to be: Compare Plans: Look at different plans and see what they offer. Don’t just go for the cheapest option—make sure it covers what you need. Consider the Destination: Some places have higher medical costs or different risks. Make sure your plan fits your destination. Ask Questions: Don’t be shy! Ask insurers about coverage limits, exclusions, and how to make a claim. It’s better to know upfront. Let’s Wrap It Up So, do you really need travel insurance? If you want peace of mind, financial protection, and a safety net for those unexpected moments, the answer is a resounding yes. As you plan your summer adventures, consider adding travel insurance to your checklist. It might just be the best decision you make for your vacation. Call to Action Ready to make your travel plans worry-free? Contact us today for a free consultation and get a travel insurance quote tailored to your needs. Visit our website or give us a call—we’re here to help you travel smart and stay safe. So there you have it! Travel insurance might not be glamorous, but it’s your vacation’s best friend. Let’s make sure your summer adventures are all fun and no fuss. Happy travels! ✈️🌴

By Carmen Londono

•

April 21, 2024

Introduction Buenos Dias, Amigos! Carmen Here, Navigating the World of Autism. You know, life's a journey with unexpected twists, and when you're a parent of a neurodivergent child, those twists can be even more pronounced. Today, I want to talk about something close to my heart: finding the right insurance coverage for our autistic kiddos in Illinois. It's like a puzzle, y'know, and we're all trying to fit the pieces together. Our Shared Journey We're in this together! Whether you've just started walking this path or have been on it for a while, finding the right support for your child is crucial. It's not just about medical care; it's about understanding, patience, and love. And of course, making sure you're covered for every step of this beautiful, challenging journey. Understanding Autism What's Autism, Really? Let's break it down, mi gente. Autism is part of the beautiful spectrum of neurodiversity. It's not a one-size-fits-all label. Each child with autism shines in their unique way - some might be word wizards, while others could have a knack for numbers or art. It's about embracing their world and seeing the wonder in their eyes. Celebrating Uniqueness Remember, each child is unique. Our job? To celebrate their strengths and support their challenges. It's about finding those moments of connection, understanding their needs, and ensuring they have the tools to thrive. And that, friends, starts with having the right support system in place, including insurance coverage that understands and meets their needs. The Challenge of Finding Coverage The Insurance Labyrinth Here's the real talk: navigating insurance for autism coverage can feel like walking through a maze. In Illinois, options exist, but it's about finding that perfect fit for your family. What works for one may not work for another. It's a journey of patience, but hey, patience is something we've all got in abundance, right? Finding the Right Path Finding the right insurance coverage is crucial. It's not just about doctor visits; it's about therapies, interventions, and sometimes, medications. We want our kids to have the best, but figuring out how to make that happen within the realms of insurance... ahora eso sí que es un desafío (now that's a challenge). Insurance Options in Illinois Navigating the Choices Alright, let’s unwrap the options we've got in Illinois. No two insurance plans are the same, just like our kids, ¿verdad? There’s a variety of coverage plans out there, and we'll look at what might work best for your familia. Coverage We Need We're talking about more than just doctor visits. We need coverage for therapies, maybe some special schooling, and even certain types of equipment. It's about finding a plan that covers the breadth of what autism care can involve. Some plans might be more comprehensive, covering a wide range of therapies, while others might have limits. Let’s explore and see what resonates with your family's needs. Medicaid and Public Assistance A Helping Hand Public assistance can be a lifesaver. Medicaid, for example, might be an option if you’re looking for a helping hand. It’s designed to support low-income families and could cover many autism-related services. Yes, it's bureaucracy, but it's worth diving into for your child's sake. Other Public Programs Illinois also offers other programs that can supplement or be an alternative to Medicaid. These programs are designed to support families of children with special needs, including autism. It’s about knowing where to look, and hey, that’s what I'm here for! Private Insurance Plans Exploring Other Avenues Now, let’s chat about private insurance. These plans can offer more flexibility and sometimes more coverage options for autism-related services. Sure, they might come with a higher price tag, but they could also offer a level of care that’s worth every penny. Pros and Cons Each plan has its ups and downs, like everything in life. The key is to weigh the benefits against the costs. Some plans might offer extensive therapy coverage, which is fantastic, but always check for hidden limitations or exclusions. We're looking for a plan that’s as unique and special as our children. Navigating Insurance Policies Deciphering the Fine Print Insurance policies can be as complex, but don't worry, we'll break it down. Understanding the policy's language is crucial – it’s like learning a new dialect. Look out for terms related to autism coverage, like behavioral therapies and developmental screenings. Picking the Perfect Policy Choosing the right policy is like finding the perfect pair of shoes – it needs to fit just right. Consider what your child needs most: speech therapy? Occupational therapy? Make sure these are covered. And always, always check the limits – we don't want any surprises. Advocacy and Support Groups United We Are Strong In our community, unity is strength. There are advocacy groups in Illinois that can help you navigate these waters. They fight for better coverage and offer invaluable advice. Plus, connecting with other families on the same journey? Priceless. It’s like having a family outside of your family. Local Support Resources I’ll list some fantastic local groups and resources that can guide you. From parent support groups to educational workshops, they provide the wisdom and support we all need sometimes. It’s about building a community that understands and shares your journey. School-Based Support A Little Help from the Schools Schools can be a surprising ally in your journey. Many districts offer programs and services for autistic children, like individualized education plans (IEPs) or specialized therapy services. They might not cover everything, but they can be a significant part of the support network. Working with the School Collaborating with your child’s school can open doors to resources you might not have known existed. Communication is key – the more the school understands your child’s needs, the better they can support them. It’s a partnership, and every bit helps. Therapy and Intervention Services The Heart of Autism Support Therapies and interventions are the corazón of supporting our autistic kids. From behavioral therapy to occupational and speech therapy, these services are key. In Illinois, some insurance plans offer great coverage for these essential services. It's about finding the right fit. Early Intervention is Key Remember, the earlier these interventions start, the better. Early intervention programs can be life-changing, laying a foundation for growth and learning. Look for insurance that doesn't just cover these services, but embraces the importance of starting early. Prescription Coverage and Autism Medications and Insurance While not all autistic children need medication, some do, and it's crucial to have them covered. Whether it's for managing co-occurring conditions or other health needs, you want a plan that won't leave you struggling with costs. Ensuring Necessary Medications are Covered Make sure to check the insurance policy for prescription coverage details. Some plans might have limitations on the types of medication or the quantity. We need to ensure our children have what they need, when they need it. Alternative Therapies and Coverage Beyond Traditional Therapy There's a world of alternative therapies out there, from art therapy to equine therapy. These can be incredibly beneficial for some children. The catch? Not all insurance plans cover these. But, knowing your options can help you advocate for what your child needs. Coverage Considerations When considering alternative therapies, check with your insurance provider about what's covered. Even if they're not included, some policies offer flexible spending accounts that can be used for these therapies. It's about exploring all your options. The Impact of Insurance on Family Life More Than Just Coverage Let's get real for a moment. The right insurance does more than just pay bills—it brings peace of mind. With the right coverage, you can focus on what really matters: your family and helping your child thrive. Stories from Our Community I've heard so many stories in our community. Families who found the right coverage speak of how it transformed their lives, giving them access to essential services and support. It's about more than just medical care; it's about quality of life. Advancing Toward Better Coverage The Path Forward We've come a long way, but there's still work to be done in improving autism insurance coverage. Advocacy is key. The more we speak up, the more insurers and policymakers will understand the need for comprehensive, accessible autism coverage. How You Can Help Get involved with local advocacy groups. Share your story. The more voices we have, the louder we are, and the more change we can create. Together, we can work towards a future where every child with autism receives the support they need. Conclusion Juntos en Este Viaje We're on this journey together, dear friends. Navigating the world of autism insurance in Illinois can be challenging, but it's a road we're walking together. With the right information, support, and a bit of Carmen-style tenacity, you can find the coverage that fits your family's needs perfectly. Ready to Find the Perfect Coverage? Let's Talk! Have questions? Feeling overwhelmed? No te preocupes - I'm here for you. If this journey through autism insurance options has sparked more questions, let's sit down for a one-on-one chat. Whether you're just starting to explore insurance options or need help navigating the choices you've already made, I’m ready to lend an ear and share some advice. Book your personal consultation with me, Carmen, at the Insurance Pros. Together, we'll sift through the details, explore your unique needs, and find the coverage that feels like it's made just for you and your incredible child. Because when it comes to supporting our niños, getting the right help makes all the difference. [Schedule Your Consultation Now] - Let's take this step together. Your family's journey to the best possible support starts with a simple conversation. ¡Hablamos pronto!

By Carmen Londono

•

April 3, 2024

Welcome to The Insurance Pros, LLC, where we've got your back when it comes to deciphering the ins and outs of small group health insurance in Illinois. I'm Carmen Londoño, weaving through the ins and outs of insurance with a sprinkle of sass and a whole lot of wisdom! I'm here to help simplify health coverage for you – keeping it easy and straightforward. So, grab a cup of coffee and let's dive in! What's the Deal with Small Groups? Let me paint you a picture: you're a small business owner in Illinois, hustling hard with your crew of rockstars. But when it comes to health insurance, where do you even start? Sound familiar? Well, we've got your back! In Illinois, a small group typically means you've got anywhere from 2 to 50 full-time equivalent employees. Yep, it's a cozy crew, and we're here to make sure everyone's covered. Guaranteed Goodness In Illinois, we don't play favorites when it comes to health insurance. This "guaranteed issue" in the context of health insurance refers to a regulation that mandates health insurance providers to offer coverage to any applicant, regardless of their health status. This includes factors like pre-existing conditions, age, or past health history. This policy is particularly significant for individuals who may have been denied coverage in the past due to their health issues. Whether you're a yoga guru or a pizza enthusiast, everyone gets a shot at coverage. It's like Oprah handing out insurance policies – "You get coverage! And you get coverage! Everybody gets coverage!"

By Carmen Londono

•

January 29, 2024

It's with immense pride and joy that we announce an extraordinary accomplishment by The Insurance Pros. Our team's commitment to excellence and unwavering dedication to service has propelled us into a remarkable spotlight. We have been honored with a prestigious accolade that not only marks our proficiency but also our heartfelt commitment to the well-being of our community. The Insurance Pros has been recognized by the Health Insurance Marketplace® as a member of the 2024 Marketplace Circle of Champions for helping consumers gain qualified health coverage. This award from the Centers for Medicare & Medicaid Services (CMS) underscores The Insurance Pros’s success in actively assisting consumers during this Open Enrollment Period and demonstrates its expertise and dedication to helping consumers find health coverage. Note from Centers for Medicare & Medicaid Services (CMS) January 29, 2024 Skokie, IL The Insurance Pros has been recognized by the Health Insurance Marketplace® as a member of the 2024 Marketplace Circle of Champions for helping over 20 consumers gain qualified health coverage. This award from the Centers for Medicare & Medicaid Services (CMS) underscores The Insurance Pros’s success in actively assisting consumers during this Open Enrollment Period and demonstrates it's expertise and dedication to helping consumers find health coverage. “We thank The Insurance Pros for its dedication to providing exceptional service and helping consumers access coverage,” said Ellen Montz, Director of the Center for Consumer Information and Insurance Oversight within CMS, which oversees the Marketplace. “Agents and brokers are important partners to CMS in our shared goal of helping expand access to coverage across the nation.” Consumers who would like help enrolling or have questions about their coverage can contact The Insurance Pros at 312-210-4456.

By Carmen Londono

•

January 29, 2024

The Backbone of Our Communities In the heart of our vibrant neighborhoods, small businesses stand as beacons of innovation, resilience, and community spirit. From the cozy corner café brewing the morning's first coffee to the local bookstore curating tales that span the globe, these enterprises do more than just provide goods and services. They weave the rich tapestry of our community, creating spaces where ideas flourish and bonds strengthen. Yet, the journey of a small business owner is paved with unforeseen challenges. In these moments, the difference between a setback and a downfall often lies in the safety nets we put in place. Among these, insurance emerges not just as a regulatory checkbox but as a strategic tool, empowering business owners to navigate the stormiest of weathers with confidence. This blog post delves into the indispensable role of insurance in safeguarding small businesses. It's a guide to transforming vulnerabilities into strengths, ensuring that your business, the embodiment of your hard work and dreams, stands resilient against the tides of uncertainty. Why Insurance is Crucial for Small Businesses Navigating the entrepreneurial landscape, small business owners often encounter storms unforeseen. These tempests manifest not as claps of thunder but as challenges that test the very foundation businesses are built upon. A customer slip-and-fall incident, a fire ravaging through inventory, or an unexpected business interruption - each scenario, a bolt from the blue, threatening to disrupt the harmony of hard-earned success. Insurance: The Shield Against the Unpredictable Imagine, for a moment, a quaint bakery, "Sweet Endeavors," nestled in a bustling neighborhood. The bakery, a product of its owner's passion, has become a beloved community staple. Then, one fateful day, a kitchen fire, sparked by a fleeting oversight, engulfs this dream in flames. Here, insurance transcends its role from a mere contractual obligation to a beacon of hope. It's not just about repairing damages; it's about rekindling dreams, ensuring "Sweet Endeavors" rises from the ashes, stronger and more resilient. Beyond Repairs: The Broader Impact of Insurance The significance of insurance extends beyond the tangible. It's about continuity and confidence. For countless entrepreneurs, insurance means not just the restoration of their business but the preservation of a community landmark. It's the reassurance to employees that their livelihoods are protected, the guarantee to customers that their favorite gathering spot will reopen its doors, and the promise to the business owner that their aspirations are shielded against life's unpredictabilities. In this tapestry of enterprise and community, insurance stands as the thread that mends the unforeseen tears, ensuring that the vibrant hues of small businesses continue to flourish unabated. Types of Insurance Small Businesses Should Consider In the intricate dance of entrepreneurship, where each step forward is a leap towards realizing a vision, the right insurance acts as the rhythm that ensures the music never stops, even when faced with unforeseen obstacles. For a small business, the selection of insurance is not just about protection; it's about crafting a safety net that is as unique and diverse as the dreams it seeks to safeguard. General Liability Insurance: The Foundation At the core of a small business's insurance portfolio is General Liability Insurance. Picture this as the shield that guards against the slings and arrows of everyday business operations. Whether it's a customer slipping on a wet floor in a café or a faulty product causing unintended harm, general liability insurance stands as the steadfast defender against third-party claims of injury or property damage. Workers' Compensation: Valuing People People are the heartbeat of any small business. Workers' Compensation Insurance embodies this value, offering a lifeline to employees in the event of work-related injuries or illnesses. It's more than just compliance with legal mandates; it's a testament to a business's commitment to its team, ensuring that in times of need, support is but a heartbeat away. Professional Liability Insurance: Safeguarding Expertise In a realm where advice is both service and product, Professional Liability Insurance, or Errors and Omissions Insurance, serves as the armor. For consultants, accountants, and architects, whose work hinges on the precision of their expertise, this insurance provides protection against claims of negligence or harm caused by professional advice or services rendered. Commercial Property Insurance: Protecting the Physical Realm Brick and mortar form the stage upon which the ballet of business unfolds. Commercial Property Insurance ensures that this stage remains intact, covering losses from fire, theft, or natural disasters. It's the peace of mind that comes from knowing the physical embodiments of one's dream are shielded against the caprices of fate. Business Income Insurance: Ensuring Continuity The melody of business is its revenue, a tune that must continue unabated for the dance to go on. Business Income Insurance acts as the conductor, ensuring that even in the face of disruptions like a fire or a major theft, the music of business—its ability to generate income—remains unbroken. Cyber Security Insurance: Safeguarding Digital Assets In the modern rhythm of business, data and digital operations are keynotes in the composition of success. Cyber Security Insurance is the vigilant guardian that stands watch over these digital realms. It ensures that in the event of cyber attacks such as data breaches or system hacks, the harmony of business—its digital integrity and online revenue streams—continues without a pause. Amidst the dynamics of the digital age, Cyber Security Insurance plays an indispensable role, orchestrating a layer of defense that aligns with the intricate patterns of cyber risks faced by businesses. It's about crafting a shield where each policy is a countermeasure, resonating with the unique digital vulnerabilities of the enterprise, ensuring that no matter the cyber threat, the performance endures. Assessing Insurance Needs and Determining Coverage In the grand theater of business, where each decision can sway the storyline, choosing the right insurance is akin to selecting the perfect cast for a play. It's about understanding the roles, the potential plot twists, and ensuring that each character can withstand the drama of unforeseen events. For a small business owner, this process is not just about ticking boxes; it's a strategic maneuver in the game of risk and protection. Step into the Director's Chair: Knowing Your Business The journey begins with a deep dive into the essence of your business. What are the main acts? Who are the key players? From the nature of your services to the location of your operations, every detail is a piece of the puzzle. It's about painting a vivid picture of your business landscape, identifying potential hazards lurking in the wings, and understanding the unique vulnerabilities of your enterprise. The Script of Risks: Identifying Potential Perils With the stage set, the next act involves scripting the possible challenges your business might face. Natural disasters, legal disputes, data breaches—the threats are as varied as they are unpredictable. This is where risk assessment comes into play, a meticulous process of mapping out scenarios, from the most probable to the least likely, yet potentially devastating. Casting the Protectors: Matching Risks with Insurance Types With the risks laid bare, the casting begins. Each type of insurance is a character, ready to play its part in safeguarding your business. The art lies in matching these characters to the roles dictated by your risk assessment. General Liability Insurance for the slips and falls, Professional Liability for the advisory missteps, Property Insurance for the tangible treasures of your enterprise—the list is tailored to the narrative of your business. Rehearsals and Fine-Tuning: Customizing Your Coverage But casting is only the beginning. Each role needs refinement, rehearsals to ensure that when the curtain rises, your insurance ensemble performs flawlessly. This might mean adjusting coverage limits, understanding deductibles, and adding riders or endorsements to cover specific scenarios. It's a dynamic process, requiring continuous engagement and a willingness to adapt as your business evolves. The Final Act: A Symphony of Protection In this strategic interplay of assessment and selection, the aim is to orchestrate a symphony of protection that resonates with the unique rhythm of your business. It's not just about having insurance; it's about having the right insurance, a harmonized ensemble that stands ready to support your business through thick and thin. As the director of this intricate production, your role is to ensure that when the unforeseen strikes, your business is not a tragedy but a tale of resilience and continuity. Common Mistakes and Tips for Navigating Policies Navigating the complexities of business insurance is akin to walking through a maze, where each decision can lead you closer to protection or further into vulnerability. In this intricate dance, small business owners sometimes stumble, making missteps that can leave their ventures exposed to unforeseen risks. The Trap of Underestimation One common misstep is underestimating coverage needs. It's like preparing for a light shower when a storm is brewing. This oversight, whether it's undervaluing assets or underestimating potential liabilities, can lead to inadequate coverage that fails to fully protect the business when it's most needed. Overlooking the Fine Print Understanding your insurance policy is crucial, yet many overlook the details tucked away in the fine print. These details, including exclusions and limitations, are the nuts and bolts of your coverage. Ignoring them can lead to unexpected gaps in protection, only discovered when you find yourself needing to make a claim. Neglecting Essential Coverages Skipping over certain types of insurance is akin to leaving doors unlocked in a storm. Whether it's foregoing cyber liability insurance in our digital age or overlooking business interruption insurance, such omissions can leave a business unguarded against specific, yet critical, challenges. Navigating with Precision: Tips for a Clear Path To ensure a clear path through the insurance landscape, consider the following strategies: Comprehensive Risk Assessment: Start with a detailed examination of your business's risk landscape to identify all potential challenges and the corresponding coverage needed. Professional Guidance: Just as a guide can help you through unfamiliar terrain, insurance professionals can provide clarity on policy complexities, ensuring your coverage is both comprehensive and tailored to your needs. Regular Policy Updates: The business world is dynamic, with new risks emerging as your business grows and changes. Regularly updating your insurance policies ensures that your coverage evolves in step with your business, providing ongoing protection against new threats. In navigating the world of business insurance, the goal is to ensure that your coverage is as robust and adaptive as the business it protects. By avoiding common pitfalls and approaching policy selection with care, you can secure a foundation of protection that supports your business's growth and resilience. The Empowering Role of Insurance in Business Growth In the narrative of small business, insurance plays a pivotal role, not just as a guardian against the unforeseen, but as a catalyst for growth and expansion. It's the underpinning force that transforms challenges into stepping stones, enabling businesses to reach new heights with confidence and assurance. A Foundation for Fearless Innovation With the right insurance in place, small business owners can embrace innovation with open arms. It's the safety net that allows for experimentation and risk-taking, essential ingredients for growth and differentiation in a competitive market. Knowing that the potential fallout of new ventures is mitigated, entrepreneurs can push boundaries, explore new markets, and introduce novel products or services without the looming fear of catastrophic losses. Attracting Talent and Building Trust Moreover, comprehensive insurance coverage is a key factor in attracting and retaining top talent. Employees seek stability and protection, not just for themselves but for the environment they commit their skills to. A well-insured business is a testament to an employer's commitment to creating a secure and thriving workplace, thereby attracting a workforce that is motivated, loyal, and driven. Facilitating Financial Stability and Opportunities Insurance also plays a crucial role in ensuring financial stability. By protecting against significant financial losses, it maintains the business's cash flow and financial health, making it possible to invest in growth opportunities. Whether it's expanding to new locations, investing in research and development, or enhancing operational capacities, insurance provides the financial backbone to support these ventures. Cultivating Customer Confidence In the eyes of customers and clients, a well-protected business is a reliable partner. Insurance coverage for product liability, professional errors, and operational disruptions assures customers that the business is responsible and trustworthy. This confidence not only strengthens existing relationships but also attracts new clients, further driving growth and expansion. Insurance as a Growth Enabler In the grand tapestry of small business, insurance is more than just a line item on the balance sheet. It's a strategic tool that empowers businesses to navigate the complexities of the market with confidence. By fostering innovation, attracting talent, ensuring financial stability, and building trust with customers, insurance acts as a cornerstone for sustainable growth and long-term success. As small business owners, embracing the full potential of insurance is not just about safeguarding what you have built but about unlocking the doors to future possibilities. With a robust insurance strategy, the path to growth is not just secured; it's illuminated with the promise of new horizons and endless possibilities. Take the Next Step: Secure Your Business's Future Today Ready to transform the potential of your small business into reality? Don't let unforeseen challenges derail your dreams. Take action today by reviewing your insurance needs and ensuring your coverage matches the unique journey of your business. Reach out to our team at Insurance Pros for a personalized consultation. Together, we can craft an insurance strategy that not only protects your enterprise but also propels it towards growth and success. Secure your business's future now, and unlock the doors to endless possibilities. Call us today for a free insurance review and/or audit

By Carmen Londono

•

January 28, 2024

As we reflect on the recent open enrollment period, our hearts are filled with immense gratitude for each and every one of our cherished clients. Your unwavering trust in The Insurance Pros has not only been the cornerstone of our success but has also deeply inspired us. From the bustling small businesses igniting our communities with their energy to the visionary entrepreneurs shaping our future, from the robust larger companies setting industry standards to the warm families that form the backbone of our society, each of you has entrusted us with something invaluable—your peace of mind and security for the year ahead. Major Achievements and Milestones This open enrollment period was more than just a routine exercise; it was a testament to what we can achieve together. With your collaboration, we navigated the complexities of securing benefits for 2024, ensuring that every individual, family, and business found a plan that resonated with their unique needs and aspirations. The tapestry of our achievements is rich and varied, woven with the stories of businesses, both small and large, and individuals from all walks of life, each securing their right to health and wellbeing. Our Commitment to You Our journey through the open enrollment period was characterized by personalized, one-on-one consultations, where we delved into the intricacies of your needs and goals. Through countless phone conversations, in-person meetings, and thoughtful discussions, we endeavored to demystify the insurance landscape, ensuring that the coverage you chose was perfectly aligned with your needs and budget. Our approach has always been to serve not just as advisors but as partners who are deeply invested in your wellbeing. Client-Centric Approach: Our Core Value The feedback and stories shared by you, our clients, are the beacon that guides our path forward. Each piece of feedback, each shared experience, is a building block in our mission to refine and enhance our services. The insights we've gained are invaluable, shedding light on how we can make the insurance journey even more accessible and tailored to your evolving needs. Looking Forward: Continuous Support and Partnership Our commitment to you extends far beyond the open enrollment period. Insurance Pros is more than just a service provider; we are a steadfast ally in your journey through the complexities of insurance. Our promise to you is one of unwavering support, always just a phone call away, ready to assist, advise, and advocate on your behalf. A Renewed Promise In closing, we reiterate our heartfelt thanks for the trust you've placed in us. It's a privilege to serve you and to be a part of your journey. As we look to the future, we renew our pledge to uphold the highest standards of service, to prioritize your needs and satisfaction, and to continue earning the trust you've so generously given us. We invite you to stay connected, to reach out with your questions, concerns, and feedback. Your voice is crucial in shaping our journey forward. Together, let's continue to build a partnership that stands the test of time, ensuring your peace of mind and security in the years to come. Thank you for your trust, your partnership, and for choosing Insurance Pros.

Blue Cross Blue Shield of Illinois Updates Network Agreement with NorthShore University HealthSystem

By Carmen Londono

•

May 9, 2023

As your health insurance agent, we are excited to share some great news with you. Blue Cross Blue Shield of Illinois (BCBSIL) has...

By Carmen Londono

•

January 3, 2020

Are you self-employed? If you answered yes to this question than you might qualify for a small group policy. Did you know that some...

Ready to safeguard your business, assets, or personal well-being? Contact The Insurance Pros at (312) 210-4456. Let's build a shield around what matters most to you.

CONTACT INFORMATION

Phone:

(847) 954-7787

Fax: (773) 423-9204

Email:

info@insurepros.net

BUSINESS HOURS

Monday - Friday 8:00 am to 5:00 pm

Saturday 8:00 am to 12:00 pm

Sunday Closed

Content, including images, displayed on this website is protected by copyright laws. Downloading, republication, retransmission or reproduction of content on this website is strictly prohibited. Terms of Use

| Privacy Policy